Friendship, Maine

Parts of this article (those related to demographics) need to be updated. (May 2023) |

Friendship, Maine | |

|---|---|

| |

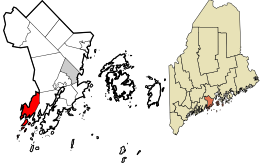

Location in Knox County and the state of Maine. | |

| Coordinates: 43°59′1″N 69°20′20″W / 43.98361°N 69.33889°W | |

| Country | United States |

| State | Maine |

| County | Knox |

| Incorporated | 1807 |

| Villages | Friendship East Friendship Lawry |

| Area | |

• Total | 31.37 sq mi (81.25 km2) |

| • Land | 14.10 sq mi (36.52 km2) |

| • Water | 17.27 sq mi (44.73 km2) |

| Elevation | 20 ft (6 m) |

| Population (2020) | |

• Total | 1,142 |

| • Density | 81/sq mi (31.3/km2) |

| Time zone | UTC-5 (Eastern (EST)) |

| • Summer (DST) | UTC-4 (EDT) |

| ZIP code | 04547 |

| Area code | 207 |

| FIPS code | 23-26805 |

| GNIS feature ID | 0582484 |

Friendship (formerly known as Meduncook) is a town in Knox County, Maine, United States. It is 31 miles (49.9 km) southeast of Augusta. The population was 1,142 at the 2020 census.[2]

History

[edit]Abenaki Native Americans called it Meduncook, meaning "bay at the end of the sandbar". Part of the Waldo Patent, it was first settled in 1750. A garrison was built on Garrison Island, which is connected to the mainland at low tide. By 1754, 22 families lived in Meduncook, most taking shelter within the garrison when the French and Indian War broke out.

Raid on Meduncook (1758)

[edit]During the French and Indian War, the community was raided twice. The first attack was from the Abenaki just after sunrise on May 22, 1758.[3] They killed and scalped Joshua and Hannah Bradford and their infant son, Winslow. An original settler from Kingston, Massachusetts, and a great-grandson of Governor William Bradford, Joshua had remained in his house, believing it close enough to the garrison that his family could flee there when necessary, but, while pounding corn, the Bradfords missed hearing the garrison's alarm gun. Five of their children managed to escape their pursuers into the fort, but two of their sons Cornelius (21) and Joshua (12) were captured and carried to Canada.[4]

After trying to lay siege to Thomaston, Maine, in September 1758, a party of Native Americans and Acadians under the command of the French officer Boishebert, raided the village. Eight British were captured or killed.[3]

On February 25, 1807, Meduncook Plantation was incorporated as Friendship. By 1859, when the population was 691, the village had two shipbuilders, two gristmills, one shingle mill and three sawmills. By 1880, when the population was 938, other manufactures included sails, carriages, boots and shoes. Boatbuilding remained the dominant industry in town, which became famous for producing the Friendship Sloop, a gaff-rigged sailboat designed for lobstering and fishing. Each summer the town hosts the Friendship Sloop Races.[5]

The author John Cheever wrote his 1957 novel, The Wapshot Chronicle, while vacationing here.

Attractions

[edit]The Friendship Museum was established in 1964.[6] Before being as the town's museum, it was the Friendship Grammar School from 1851 to 1923. The museum is a typical one-room schoolhouse, measuring 20 by 25 feet (6.1 m × 7.6 m). The museum has many interesting artifacts including models of ships and plans for the famous Friendship sloops.[7]

Geography

[edit]According to the United States Census Bureau, the town has a total area of 31.37 square miles (81.25 km2), of which 14.10 square miles (36.52 km2) is land and 17.27 square miles (44.73 km2) is water.[1] Located on a peninsula that projects into the Gulf of Maine, Friendship lies between Muscongus Bay and the Friendship River. It includes several islands, the largest of which is Friendship Long Island (or Meduncook Island).

The town is crossed by state routes 97 and 220. It borders the towns of Waldoboro to the northwest, and Cushing to the east.

The town is the site of Franklin Island National Wildlife Refuge.

Climate

[edit]This climatic region is typified by large seasonal temperature differences, with warm to hot (and often humid) summers and cold (sometimes severely cold) winters. According to the Köppen Climate Classification system, Friendship has a humid continental climate, abbreviated "Dfb" on climate maps.[8]

Demographics

[edit]| Census | Pop. | Note | %± |

|---|---|---|---|

| 1810 | 480 | — | |

| 1820 | 587 | 22.3% | |

| 1830 | 634 | 8.0% | |

| 1840 | 725 | 14.4% | |

| 1850 | 691 | −4.7% | |

| 1860 | 770 | 11.4% | |

| 1870 | 890 | 15.6% | |

| 1880 | 938 | 5.4% | |

| 1890 | 877 | −6.5% | |

| 1900 | 814 | −7.2% | |

| 1910 | 776 | −4.7% | |

| 1920 | 696 | −10.3% | |

| 1930 | 742 | 6.6% | |

| 1940 | 747 | 0.7% | |

| 1950 | 772 | 3.3% | |

| 1960 | 806 | 4.4% | |

| 1970 | 834 | 3.5% | |

| 1980 | 1,000 | 19.9% | |

| 1990 | 1,099 | 9.9% | |

| 2000 | 1,204 | 9.6% | |

| 2010 | 1,152 | −4.3% | |

| 2020 | 1,142 | −0.9% | |

| U.S. Decennial Census[9] | |||

2000 census

[edit]At the 2000 census,[10] there were 1,204 people, 508 households and 354 families residing in the town. The population density was 85.9 per square mile (33.2/km2). There were 849 housing units at an average density of 60.5 per square mile (23.4/km2). The racial make-up of the town was 99.34% White, 0.25% from other races and 0.42% from two or more races. Hispanic or Latino of any race were 0.50% of the population.

There were 508 persons living alone who were 65 years of age or older. The average household size was 2.37 and the average family size was 2.76.

20.9% of the population were under the age of 18, 6.9% from 18 to 24, 26.2% from 25 to 44, 26.3% from 45 to 64 and 19.7% were 65 years of age or older. The median age was 43 years. For every 100 females, there were 97.7 males. For every 100 females age 18 and over, there were 97.5 males.

The median household income was $39,348 and the median family income was $41,648. Males had a median income of $29,605 and females $19,000. The per capita income was $20,409. About 8.3% of families and 11.0% of the population were below the poverty line, including 16.7% of those under age 18 and 11.0% of those age 65 or over.

2010 census

[edit]At the 2010 census,[11] there were 1,152 people, 508 households and 352 families residing in the town. The population density was 81.7 per square mile (31.5/km2). There were 896 housing units at an average density of 63.5 per square mile (24.5/km2). The racial make-up of the town was 99.2% White, 0.2% Asian, 0.3% from other races and 0.3% from two or more races. Hispanic or Latino of any race were 0.3% of the population.

There were 508 households, of which 21.3% had children under the age of 18 living with them, 56.7% were married couples living together, 7.9% had a female householder with no husband present, 4.7% had a male householder with no wife present and 30.7% were non-families. 24.2% of all households were made up of individuals, and 11.2% had someone living alone who was 65 years of age or older. The average household size was 2.27 and the average family size was 2.66.

The median age in the town was 50.1 years. 17.2% of residents were under the age of 18, 7% were between the ages of 18 and 24, 18.7% were from 25 to 44, 31.7% were from 45 to 64 and 25.3% were 65 years of age or older. The gender make-up of the town was 50.4% male and 49.6% female.

As of 2022, the population of Friendship was estimated at 1,162 people.[12]

Schools

[edit]Friendship is part of the Maine School Administrative District 40.[13] Friendship Village Elementary School is in Friendship.

Medomak Valley Middle School and Medomak Valley High School are in nearby Waldoboro.

Friendship Public Library is in the community.[14]

In popular culture

[edit]- The majority of the 1995 film Casper was set in Friendship, though the production crew chose the nearby resort town of Camden for filming, citing it to be "more authentic". In the film, Friendship is the site of an Art Nouveau mansion called Whipstaff Manor, which is haunted by four ghosts. Whipstaff Manor is not a real mansion located on the sea front of eastern Camden. The lower exterior and interior of the mansion was built on a set.

- The short story "The Run of Yourself" in Sorry for Your Trouble by Richard Ford is set in Friendship.

Notable people

[edit]- Allen Alexander Bradford, U.S. congressman[citation needed]

- Jayne Loader, director, writer[citation needed]

References

[edit]- ^ a b "US Gazetteer files 2010". United States Census Bureau. Retrieved December 16, 2012.

- ^ "Census - Geography Profile: Friendship town, Knox County, Maine". Retrieved January 21, 2022.

- ^ a b William Durkee Williamson. The history of the state of Maine: from its first discovery, ... Vol. 2. p. 33.

- ^ Coolidge, Austin J.; Mansfield, John B. (1859). A History and Description of New England. Boston, Massachusetts: A.J. Coolidge. pp. 132–133.

- ^ Varney, George J. (1886). Gazetteer of the state of Maine. Friendship. Boston: Russell.[permanent dead link]

- ^ "Friendship Museum". Archived from the original on April 2, 2015. Retrieved April 1, 2015.

- ^ "The Collection". Friendship Museum. Archived from the original on April 2, 2015. Retrieved April 1, 2015.

- ^ Climate Summary for Friendship, Maine

- ^ "Census of Population and Housing". US Census Bureau. Retrieved June 4, 2015.

- ^ "U.S. Census website". United States Census Bureau. Retrieved January 31, 2008.

- ^ "U.S. Census website". United States Census Bureau. Retrieved December 16, 2012.

- ^ "Friendship (Town, Knox, USA) - Population Statistics, Charts, Map and Location". www.citypopulation.de. Retrieved May 17, 2024.

- ^ "Home]". Regional School Unit 40. Retrieved November 6, 2018. The "Community" tab shows the communities served.

- ^ "Community". Regional School Unit 40. Archived from the original on September 16, 2018. Retrieved November 6, 2018.